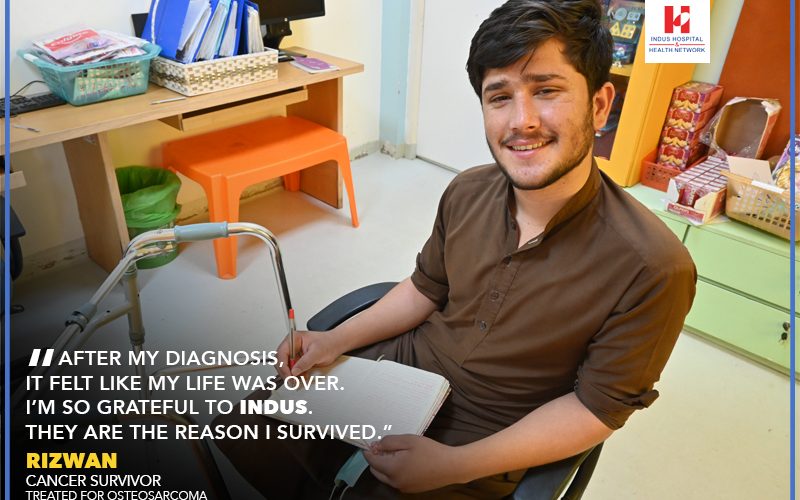

THE GUIDING TORCH OF HOPE – Rizwan

-

by

admin

Rizwan Bashir was born and raised in Kalat, Balochistan. A free-spirited child, he was passionate about reading and writing. He would spend days immersed in books and writing stories.

The village lacked basic educational facilities, so his parents would send him and his four brothers to another city for their education.

Being diagnosed with Osteosarcoma

Rizwan was 16-years old when he started feeling a stabbing pain in his leg. Soon, it had become so unbearable that he could barely breathe. At that time, he was preparing for his 9th-grade examinations and helping his brothers with their studies. His father advised him to take some painkillers to relieve the pain. But as soon as it wore off, the pain would come roaring back worse than ever.

His family was worried about his health and noticed that his pain was affecting his daily routine. They went to a doctor, who told them that he had suffered a leg fracture and required bed rest to recover. The news did not sit right with Rizwan, but he complied nonetheless. After a few weeks with no improvement, the family traveled to a local hospital. The doctors ran tests on him, including an MRI and an X-Ray. Although they confirmed that he did not have a fracture, they still could not find the problem with his leg.

His father borrowed money from friends and relatives to travel to Karachi. He was determined to find a hospital that would provide the medical help Rizwan needed. The private hospital they attended diagnosed Rizwan with osteosarcoma in his left leg. Osteosarcoma is a type of bone cancer most often found in the legs but sometimes in the arms. It tends to occur in teenagers and young adults, but it can also occur in younger children and older adults. Treatment usually involves chemotherapy, surgery, and, sometimes, radiation therapy.

Coming to the Indus Hospital, Korangi Campus

Desperate and running low on funds, the local doctors informed his family of The Indus Hospital, Korangi Campus. The hospital had all the facilities that could help them treat cancer completely free of cost. The staff admitted him to the Oncology Emergency Department, where they placed him under chemotherapy.

The first few months were difficult for Rizwan. As a result of chemo, his condition worsened so much that the doctors contemplated amputating his leg. Despite the shame he felt at losing his hair due to chemotherapy, the excruciating pain of having rods attached to his leg, and the terror of possibly losing his leg, Rizwan never gave up hope. The doctors worked hard to save his leg. Thankfully, they were able to avoid amputating his leg after performing a successful surgery.

Earning recognition for his work

Rizwan soon grew popular with the staff and patients at the Oncology Department and socialized with everyone he met. Doctors and nurses would go out of their way to introduce new patients to him. They knew that his optimistic attitude and easy manner of talking would help put them at ease. During his time in chemo, he published a small book. It won first place in the Global Forum for Teacher Educators Art Activity competition. He is currently completing his last round of chemo and plans to explore Karachi city further. In addition, he intends to finish his second novella, a psychological thriller called Lady Joker.

When asked if he had any advice for future patients, he says to stay positive, not lose hope, and come out of your shell. Hope had helped him and his family endure their four-year journey. The now-19-year-old expresses his hope to one day become an oncologist. He wants to help patients the way the doctors at The Indus Hospital have helped him.